What does the Autumn Budget mean for the housing market?

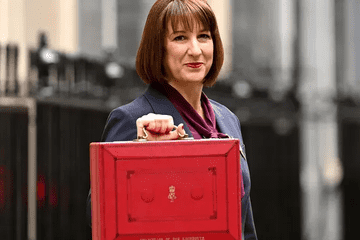

Chancellor Rachel Reeves has delivered her Autumn Budget: the first Labour Budget in 14 years

The ongoing cost of living pressures likely contributed to the recent coverage and speculation the Budget has received. Mortgage rates remain high, with our recent study showing that the average first-time buyer mortgage payment is £350 higher than five years ago. Household energy bills, while down from their 2022 peak, rose by 10% this month under the latest energy price cap.

Rightmove recently surveyed over 34,000 people to determine what they wanted to see from the new government. An overwhelming majority of renters (60%) said they wanted more support for first-time buyers while simplifying the home-buying process was the most important for existing homeowners.

What changes were announced for housing in the Autumn Budget?

Housing announcements included £5 billion government investment to deliver Labour's housing plan, with a £500 million boost to the Affordable Homes Programme. Investment is planned for sites across the country, such as Liverpool Central Docks, with 2,000 new homes and a waterfront transformation.

There will also be £25 million put towards the delivery of 3,000 energy-efficient new homes across the country, with a target of 100% being affordable.

Capital Gains Tax on residential property will remain unchanged.

The government has also pledged to engage with industry on plans to permanently make the Mortgage Guarantee Scheme available to support lending at 95% loan-to-value.

What's happening with stamp duty?

The Budget should have mentioned extending the current stamp duty relief for first-time buyers, which is due to end in March 2025.

Stamp duty is a tax paid to the government when buying property or land. The amount buyers pay varies based on the property's value cost, whether they're buying a home to live in or an additional home.

The stamp duty surcharge for those buying second homes, such as landlords buying properties to rent out, is set to rise by 2% from 31 October 2024, increasing from 3% to 5%.

Our property expert, Matthew Marchant, says: "Increasing stamp duty on additional home purchases means that, based on the average asking price for a home, a landlord could face an additional charge of more than £7,000 from tomorrow. In the short term, some landlords may need to pause for thought, but in the longer term, we expect it becomes another charge that landlords become accustomed to considering."

The previous Conservative government adjusted stamp duty thresholds until March 2025, which meant that home-movers would pay lower stamp duty fees, and in many cases (primarily for first-time buyers), meant no stamp duty to pay at all. There were no announcements about extending the elevated thresholds, meaning these are set to drop back at the end of March 2025. Matthew says: "With the rate at which no stamp duty is charged for home-movers due to fall from £250,000 to £125,000, anyone purchasing a property over this amount could face paying up to £2,500 more in stamp duty land tax. Meanwhile, the threshold rate at which first-time buyers do not pay stamp duty will likely fall from £425,000 to £300,000. If a first-time buyer buys a property at the average UK price of £370,759, they will pay £3,538 in stamp duty from March 2025, compared with nothing now."

"We may now see a rush of buyers, particularly those purchasing for the first time, either bringing their plans forward or trying to get their deal done before charges go up. On average, it currently takes 152 days to complete a property transaction once a sale is agreed upon, which means agreeing to a deal tomorrow to complete it on time. While this is an average and many will be hoping to complete more quickly, it highlights that those who are hoping to avoid higher charges will need to act quickly", Matthew adds.

Capital Gains Tax remains unchanged

In the run-up to the Budget, we saw some trends emerge in the housing market based on several anticipated changes. One of these talked-about changes was an increase in Capital Gains Tax, which could have seen landlords pay more tax on any income made from rental properties.

Earlier this year, we saw a record number of former rental homes for sale, as some landlords decided to sell their properties due to the rumoured tax change and other additional costs for landlords that have grown over the years. However, today's Budget has confirmed that the current rates of Capital Gains Tax on residential property will remain unchanged.

What's happening in the housing market right now?

We've seen strong levels of activity in the typically busy autumn season and lots more people looking to get on with home moves than we saw in the more muted market of 2023. The number of sales agreed is up 29% compared to last year, while the number of people enquiring about homes for sale is up 17%. Buyers will also find more choice of homes, with the number of homes for sale up 12%.

While there's lots of activity in the housing market, we saw lower-than-average house price growth this month (+0.3%), compared to the seasonal average of 1.3%. This shows that the market is still price sensitive, and sellers coming to market need to set a realistic asking price to find a buyer.

Want to check how much your home is worth? You can get an Instant Valuation here.

Or, if you'd like to talk to an agent for more personalised advice, our team are always on hand to help. We'd love to hear from you, whether just a quick chat or a no-obligation property valuation.

Warm wishes

The team at Rolstons