What's in store for house prices in 2025?

The housing market started in 2024 on a positive note—inflation, mortgage costs (and the base rate) were finally coming down, the cost-of-living crisis was abating, incomes were growing, and buyer confidence was rising. The process accelerated with the advent of spring, although affordability constraints ensured the market remained price-sensitive.

Most of 2024 was characterised by speculation about how far and fast the base rate would fall. As summer approached, those reductions turned out to be slower than expected, and an election loomed. The market moved into a state of hiatus as buyers waited for further falls.

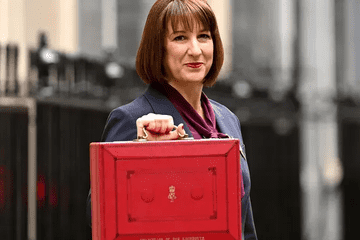

With Labour's resounding victory, some certainty returned, and when that was added to a July reduction in the base rate, confidence began rebuilding. It was only short-lived, as concerns quickly grew over what might be in Rachel Reeve's first budget in the autumn and Keir Starmer's warning of 'pain to come' and, once more, buyers went back to sitting on their hands.

Even a second reduction in the base rate only produced a muted response. Then, in October, we finally learned what Labour had in store for us, and the news was mixed about the property world. The most significant changes were to Stamp Duty, with the additional premiums for BTL and second-home buyers rising to 5% and it was also announced that rates for first-time buyers would go up on April 1st 2025. To the relief of landlords, Capital Gains Tax on properties was left more-or-less untouched, and Labour's ambitious 1.5 million housebuilding programme was broadly welcomed.

As the market digested all the changes, activity slowly picked up, and there was a spike in first-time buyer activity as they rushed to complete purchases before the spring Stamp Duty deadline.

The financial markets, though, were not quite so forgiving. Yet again, there was speculation that the government's big budget commitments would increase the cost of borrowing and slow the rate at which the base rate would come down. The housing market, however, shrugged off the news. Prices rose, and all the main indices finished the year in positive territory.

According to Halifax's figures, which are fairly typical, house prices were up by 3.3% in 2024. The North West had the strongest growth - up +5.3% compared to the previous year, with the average property now costing £238,832. London had the highest average house price in the UK, at £547,614, 3.3% up on last year.

So, what is everyone expecting the housing market to do now? Unlike last year, almost everyone is predicting house prices will rise in 2025.

However, there are some headwinds to negotiate. What happens in the housing market depends on the strength of the economy, the labour market, and the future direction of the base rate, all of which have been impacted by the Autumn Budget.

Rental & Buy To Let Market

Most expected rent rises to modify in 2024, dropping from 9% the previous year to around 5%. In the event, Homelet's Rental Index was considerably lower at +1.3%, and in Greater London, rents fell by 2.6%.

Many commentators have been suggesting for some time that rents would eventually hit the limits of affordability, which may finally be happening. However, there are concerns over renewed upward pressure on rents, with fears that the looming Renters' Rights Bill will lead to a landlord exodus and severe supply shortages.

Fortunately, there is no evidence that this is happening in significant numbers, although the legislation is still making its way through parliament.

Rolstons' Breydon Duffy says, "There are two competing factors influencing rental price changes right now. The ongoing imbalance between supply and demand is putting upward pressure on prices. On the other hand, rent rises outpacing wage growth over the past five years have stretched affordability to extreme levels, and this is showing in the increasing number of price reductions."

If you'd like to talk to an agent for more personalised advice, our team are always on hand to help. We'd love to hear from you, whether just a quick chat or a no-obligation property valuation.

Warm wishes,

The team at Rolstons