Your Watford & Hertfordshire market report

With the election over, the base rate is finally on the way down, and mortgage rates continue to fall. The housing market has bounced this August despite being the peak holiday season.

Rightmove reports that the number of potential buyers enquiring with agents about homes for sale has jumped by 19% compared to August last year. And that’s up 11% in July.

Lender Nationwide is reporting that house price rises have now reached 2.4% on an annual basis, which is the fastest pace since December 2022.

And Halifax says house prices increased by 0.3% in August, after a 0.9% rise in July.

Matthew Marchant, Director of Sales at Rolstons, says: “The first Bank Rate cut since 2020 has sparked a welcome late summer boost in buyer activity. While mortgage rates haven’t been substantially lower since the rate cut, the long-hoped-for first cut has finally arrived, and mortgage rates are heading downward, which is positive for home-mover sentiment. As the summer holiday season ends, there are conditions for a more active autumn market.”

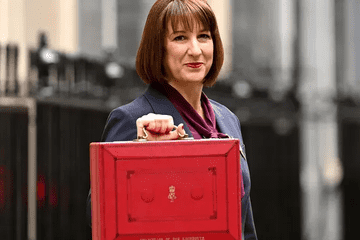

And Stephen Brick, Associate Director at Rolstons, says of the road ahead: “Providing the economy continues to recover steadily, as we expect, housing market activity is likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth. There is, however, the looming spectre of Rachel Reeves’ much-publicised autumn budget and Keir Starmer’s warning of ‘pain to come’. It remains to be seen exactly what it will mean for the property market, but in the meantime, it may at least give some movers pause for thought.”

Rental & Buy To Let Market

With the Renters’ Right Bill now making its way through parliament, the prospect of ending no-fault evictions and higher Capital Gains Tax (CGT) is leading to significant numbers of landlords leaving the market.

According to an analysis by data firm TwentyCi, the number of ex-rental properties for sale in central London has hit a 10-year high as landlords flee Labour’s threatened crackdown.

However, if, as expected, CGT is aligned with landlords’ income tax rates, it may soon become more cost-effective for them to stay put. In addition, the shortfall in rental property will likely push up rents even further. Homelet’s rental index shows the average rent was up again last month by 1.3% to £1,325. That’s a rise of 5.1% on an annual basis. After three months of falls, the biggest rise was in London, where rents jumped by 2.2% in August. The average London rent is now £2,148, with annual growth currently running at just 0.1%.

If you'd like to talk to an agent for more personalised advice, our team are always on hand to help. We'd love to hear from you, whether just a quick chat or a no-obligation property valuation.

Warm wishes,

The team at Rolstons