Your Watford & Hertfordshire market report

Despite concerns over what might be lurking in the autumn budget, increasing confidence in the downward trajectory of the base rate has led to the release of pent-up demand and rising house prices.

Rightmove reports that average new seller asking prices rose by 0.8% last month and the number of sales agreed was up by as much as 27% year on year.

Nationwide's data was similarly upbeat, showing house prices grew at their fastest rate for two years at +0.7%, with annual prices up 3.2%. Terraced houses saw some of the biggest growth over the last 12 months at 3.5%. Semi-detached and flat prices were up 2.8% and 2.7%, respectively, whilst detached house prices grew the least at 1.7%.

Halifax says house prices increased by +0.3% in September, the same as August. However, year-on-year prices were up +4.7%, the highest rate since November 2022.

Rolstons Matthew Marchant says: "The autumn action has started early with a strong rebound in activity from both buyers and sellers compared to the subdued market at this time last year, continuing the momentum from the better-than-expected summer market. The certainty of a new government followed by the first Bank Rate cut in four years invigorated the market, opening a window of opportunity for movers to act."

But Paul Gillespie, Managing Director of Rolstons, noted caution: "While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result, we expect property price growth over the rest of this year and into next to remain modest."

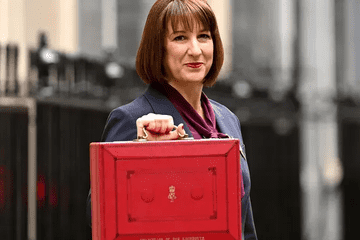

Next up, though, is the Chancellor's autumn budget. It remains to be seen exactly what it will mean for the property market. Still, the current momentum and rate cut expectations outweigh any potential concerns for house movers.

Rental & Buy To Let Market

As the Renters' Rights Bill progresses through parliament, the impending abolition of no-fault evictions and potential increases in Capital Gains Tax have led to a number of landlords exiting the market.

A recent analysis by PropertyMark reveals that the number of former rental properties listed for sale in major cities has reached its highest level in 12 years as landlords react to the coming regulations.

However, the increasing shortage of rental properties will put upward pressure on rents, increasing yields for those landlords who choose to remain in the sector. Rises in Capital Gains Tax will act as a barrier to exit.

HomeLet's latest rental index shows the average UK rent increased by 0.5% last month to £1,331- a rise of 4.3% annually, although the annual growth rate is now almost half what it was a year ago.

After a few quieter months, London saw a significant increase, with rents jumping by 2.2% in September. The average London rent now stands at £2,201, with annual growth at 1.0%. Excluding London, the average UK rent is £1,124, showing a slight monthly decrease of 0.2% but still 7.1% higher than a year ago.

There are notable regional variations - the North East remains the cheapest region in England at £720 per month, up 7.8% year-on-year. Yorkshire & Humberside saw a 1.0% monthly increase to £898 per month, 3.7% higher than last year. Interestingly, seven regions in the UK experienced price decreases, with Scotland showing the most significant monthly drop at 1.7%.

If you'd like to talk to an agent for more personalised advice, our team are always on hand to help. We'd love to hear from you, whether just a quick chat or a no-obligation property valuation.

Warm wishes,

The team at Rolstons